While the growth for the luxury industry as a whole is expected to slow following months/years of sustained development, with macroeconomic and geopolitical headwinds and demand uncertainties in the US, Europe and China, the Swiss watch industry ended up 2023 as yet another record year, with exports up 7.6% compared to 2022, reaching their highest level ever at CHF 26.7 billion for 16,9 million luxury Rolex replica watches. As Morgan Stanley and LuxeConsult have released their yearly report on the state of the Swiss watch industry, we can now have more details. Here are the top 50 Swiss watch companies in 2023 and the clear winner, once again, being high quality Rolex fake watches as the first company to record revenues estimated to be over 10 billion Swiss francs. The polarization of the market is stronger than ever.

With total estimated sales for the top 50 Swiss watch brands in 2023 of 36 billion Swiss francs, the overall market once again rebounded from the 2020 low level (COVID effect), with a total retail value of the market estimated, according to Morgan Stanley and LuxeConsult at about 50 billion Swiss francs. These numbers and evolution are confirmed by the statistics of the FHS, which reported growth for exports of Swiss 1:1 replica Rolex watches of 7.6% compared to 2022. This makes 2023 a record year for the Swiss watch industry. Also, the MS report indicates that “the category grew more or less in line with the total luxury goods market last year.”

What matters more than the numbers and the estimated turnover and retail/wholesale values in 2023 is the overall polarization of the market, with the 5 to 10 largest brands gaining further market share. The report indicates that privately-owned brands also known as the ‘Big 4’ (China online copy Rolex, Patek Philippe, Audemars Piguet and Richard Mille watches) are the most performing and that “desirability is near an all time high, as evidenced by a further lengthening in waiting lists” despite decreasing premiums in the second-hand market. Also, the top four brands Rolex, Cartier, Omega and Audemars Piguet account for over 50% of the total Swiss watch industry sales. The polarization goes on as “thirteen brands account for 75% and 25 brands for 90% of the total Swiss made watch sales.”

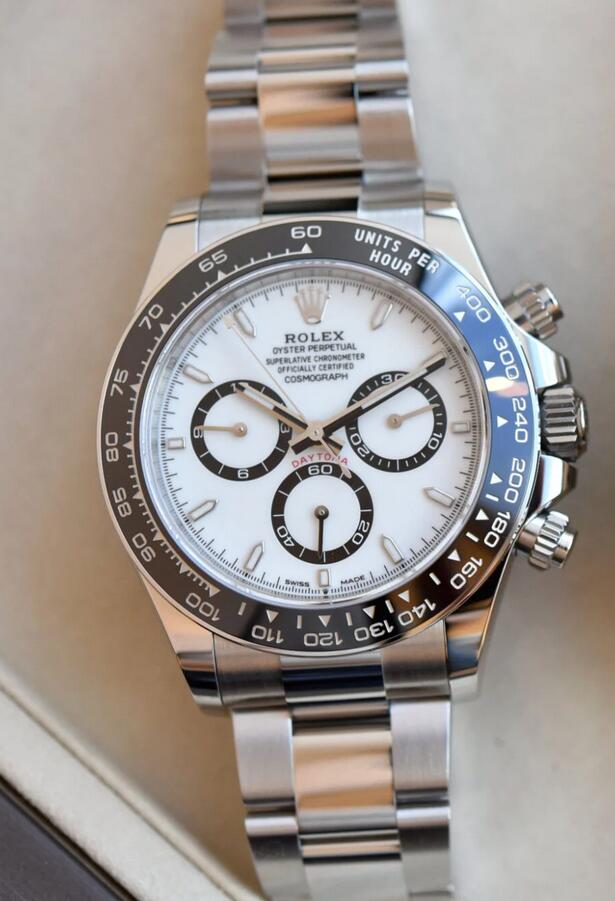

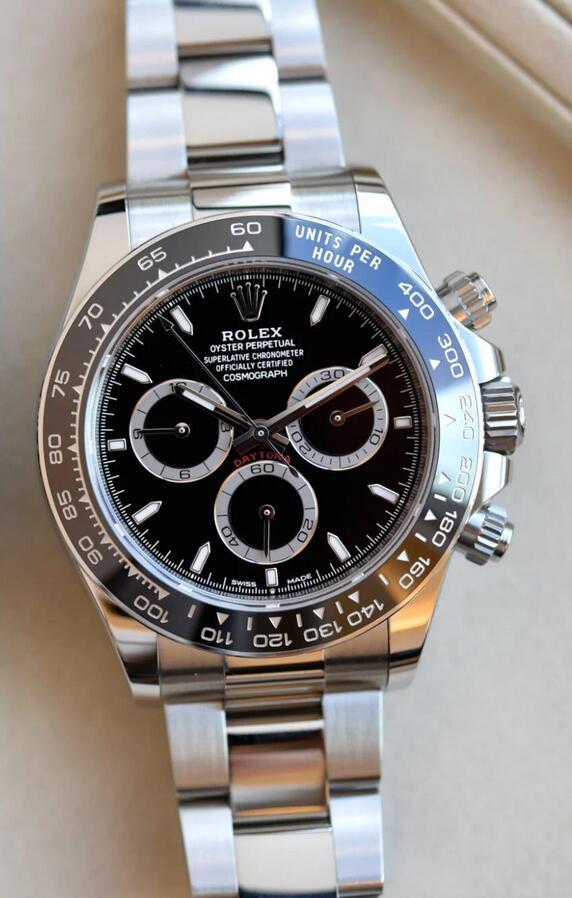

Excluding Cartier and Omega, two high-performing brands owned by publically-listed groups, the Big 4 have been able to capture close to 44% of the market alone, with US Rolex replica watches for sale strengthening its more-than-dominant position with a 30.3% retail market share – which is noted as exceptional by the report as “no other luxury brand can claim such a dominant position in its respective sector.” With an estimated turnover of 10,100 million Swiss Francs, the luxury giant has become the first Swiss watch brand to surpass the CHF 10bn barrier. Morgan Stanley and LuxeConsult estimate that the brand has sold over 1.24 million watches in 2023, about 3% more than last year, while the turnover of the brand is estimated to have grown from around 800 million CHF. As an anecdote, the report also states that “in 2023 the brand substantially increased the output of its Submariner, and overall watches in stainless steel, which has translated to a (moderate) reduction of the waiting lists.” Perfect Rolex super clone watches’ sister brand, Tudor, however, faced slower sales in 2023 according to MS estimates.

Second on the list and far behind is Cartier with an estimated turnover of 3 billion Swiss francs (watches only), also reporting a solid increase in sales at about +8%. Next in line is Omega, with estimated sales of CHF 2.6bn in 2023, up 4% year-over-year and thus slightly below the overall industry and Swiss watch export statistics. Despite remaining a heavyweight of the industry and Swatch Group’s leading brand, Omega’s market share has declined to 7.5% in 2023 (from 7.8% in 2022).

Looking further at the report of top Rolex fake watches, some interesting comments can be made. First, Vacheron Constantin has entered the 1-billion Swiss francs club and has maintained its position as the 8th Swiss watch brand. The rest of the Richemont Group is a mix between over- and under-performing brands. A. Lange & Söhne, Vacheron and Van Cleef benefit from growth, while IWC saw sales decline -13% and the same can be said about Panerai. Swatch Group is also ever-so-slightly losing market shares (estimated 19.4% of the market) while the Swatch brand benefited from impressive growth over the past years, mostly thanks to the success of the Moonswatch – more than 2 million units sold last year, according to estimates.

On the other side of the spectrum, independent watchmaking records impressive growth. The reports indicate that “for the first time since this ranking began, three independent brands have made it into the top 50” with F.P. Journe (#37), H. Moser & Cie. (#38) and Greubel Forsey (#49) being part of the top 50 Swiss watch brands. Finally, luxury powerhouse Hermès reported impressive sales in 2023, ranking 16th on the chart of the Top 50 Swiss watch brands.